Tax bracket breakout could be your way out

Everybody has a tax bracket.

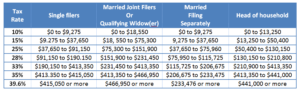

Do you know your tax bracket and how the IRS controls it? Our federal tax system is based on a progressive calculator which places taxpayers into one of seven tax brackets: 10%, 15%, 25%, 28%, 35% or 39.6%.

How do tax brackets work?

The amount of your income will fall within the range of one of the seven tax brackets; but that bracket should best be considered as your beginning, and not your bottom line. If you’re in the 28% marginal income tax bracket, does that mean the federal government is scheduled to take 28% of your income? Not exactly. Here are two main reasons:

- Exemptions and deductions are used to help determine your taxable income. This actually means that by correctly, and to the fullest legal extent, you subtract your exemptions and deductions from your gross income. The balance is the taxable income, which you want to be as little as possible.

- This remaining taxable income is then divided into chunks, each being taxed at the corresponding rate. Generally speaking, just because your taxable income falls within the range of, say 28%, your taxes are not 28% of your taxable income. In fact, no matter which bracket you’re in, you won’t necessarily pay that rate on your entire income.

Let’s flesh this out a bit.

There are a lot of examples and “what if’s” to explain this, but here are two rather common examples. Both emphasize the importance of selecting your correct and best-suited filing status, establishing an overall plan for your future, and fully understanding your deductions and exemptions to best benefit your life choices.

- Assume you’re married, filing jointly, and earning $175,000 in 2016. To estimate your 2016 taxes, start with the lowest bracket that is taxed at 10%. That’s $0 to $18,550 which would be taxed at 10%. Income from between $18,500 and $75,300 would be taxed at a rate of 15%, and the income between $75,300 and $151,900 would be taxed at a rate of 25%. Income between $151,450 and $231,450 hits the 28% tax range. Your estimated federal income tax bill would be $35,986, just above 20% of your income, not 28%.

- Take a single filer with $32,000 in taxable income. That lands him in the 15% tax bracket, but he pays just 10% on the portion of income that falls into the lowest bracket (up to $9,275), then 15% on income above that.

What else?

A lot, and it gets tricky. One of the main things you need to know for sure is the definition of all money (and things of value) which the IRS wants to know about through your tax returns. Some of these can include:

- What the IRS considers to be earned income

- Taxable interest according to the IRS

- Marital status defined by the IRS

- Rental income as explained by the IRS

According to a previous US President, the Tax Code “…has about a million pages,” which is definitely about the way it seems. At last count, however, there were less than a million, but don’t assume you have it all figured out.

What’s the bottom line?

This is not the year to leave anything to chance or to your best guess. If you’re not 100% sure you’ve got a firm hand on (and a clear understanding of) the information you plan to present to the IRS in 2017, we need to talk before the end of the year. There’s still time to make some adjustments. Call us. 479-478-6831

Here’s a short read about game-changers and the tax code.

2016 Federal Income Tax Brackets

Where is your tax bracket? These numbers are more flexible than you think. Click to enlarge.